Expansion Strategy Execution: How to Secure the Future Growth of Your Product

How to maximize new user adoption rates

In the ever-evolving realm of product growth, there is a multitude of tools and tactics for short-term KPI improvement. Expansion Strategies go beyond optimizing the core and seek adjacent markets, driving transformative success for upcoming years.

Yet, many teams find themselves falling short of their growth objectives, despite having a well-crafted strategy. Why is this the case? 🤔

The inherent challenge lies in adapting the execution process to suit the unique dynamics of expansion.

From redefining goals and embracing agility to leveraging the right discovery approaches, we will see the practices best suited for this situation.

Note: this article is part of a series describing three types of strategies and their corresponding execution playbook! (Read the first one here)

Table of contents

Successfully executing Expansion Strategies (this article)

Mutation Strategies: Embracing Bold Change for Disruptive Business Growth

Portfolio strategy and managing different types simultaneously

What is a good Expansion Strategy?

In the first article of this series, we defined Expansion strategies as “growing the horizons of our product, usually covering something new but adjacent to what we are already doing.”

This is fairly easy to grasp, but as a product leader, you must be well-versed in identifying and assessing expansion opportunities. So let’s see a list of 9 potential paths:

Geographic Expansion: Enter new regions

Vertical Expansion: Expand your product offerings or features to cater to a different industry or vertical.

Upmarket Expansion: Target higher-end customers or enterprises by offering premium versions or enhanced functionalities.

Downmarket Expansion: Target a broader customer base by introducing a scaled-down, simplified, self-onboarding version of your product.

Customer Segment Expansion: Identify and target new customer segments that can benefit from your product.

Channel and partnership expansion: Explore new distribution channels or partners to extend your product's reach.

Platform or Integration Expansion: Extend your product to new platforms or operating systems to reach a wider user base.

3rd Party Expansion: become a platform enabling others to integrate their service and attract new customers.

Service Expansion: Expand your service offerings to provide additional support, consulting, or training to your customers.

Note that many of those are “business” strategies. But of course, they must correlate with an equal product strategy enabling such expansion.

Despite what type of expansion you are seeking, a well-defined expansion strategy has the following characteristics:

Concrete: it’s precise in terms of the what/where you are expanding. “We will expand to mid-sized companies in Brazil” versus “International Expansion.”

Judicious: the most critical aspect is selecting among the multiple opportunities for expansion. We need to assess what opportunities have a big impact potential and how we are positioned to win the market (our strengths, competitors’ landscape, saturation, etcetera).

Rightly measured: finally, goals should not be about improving core-business KPIs. Expansion strategies should target early user adoption, activation, and retention to secure growth.

The execution playbook for Expansion

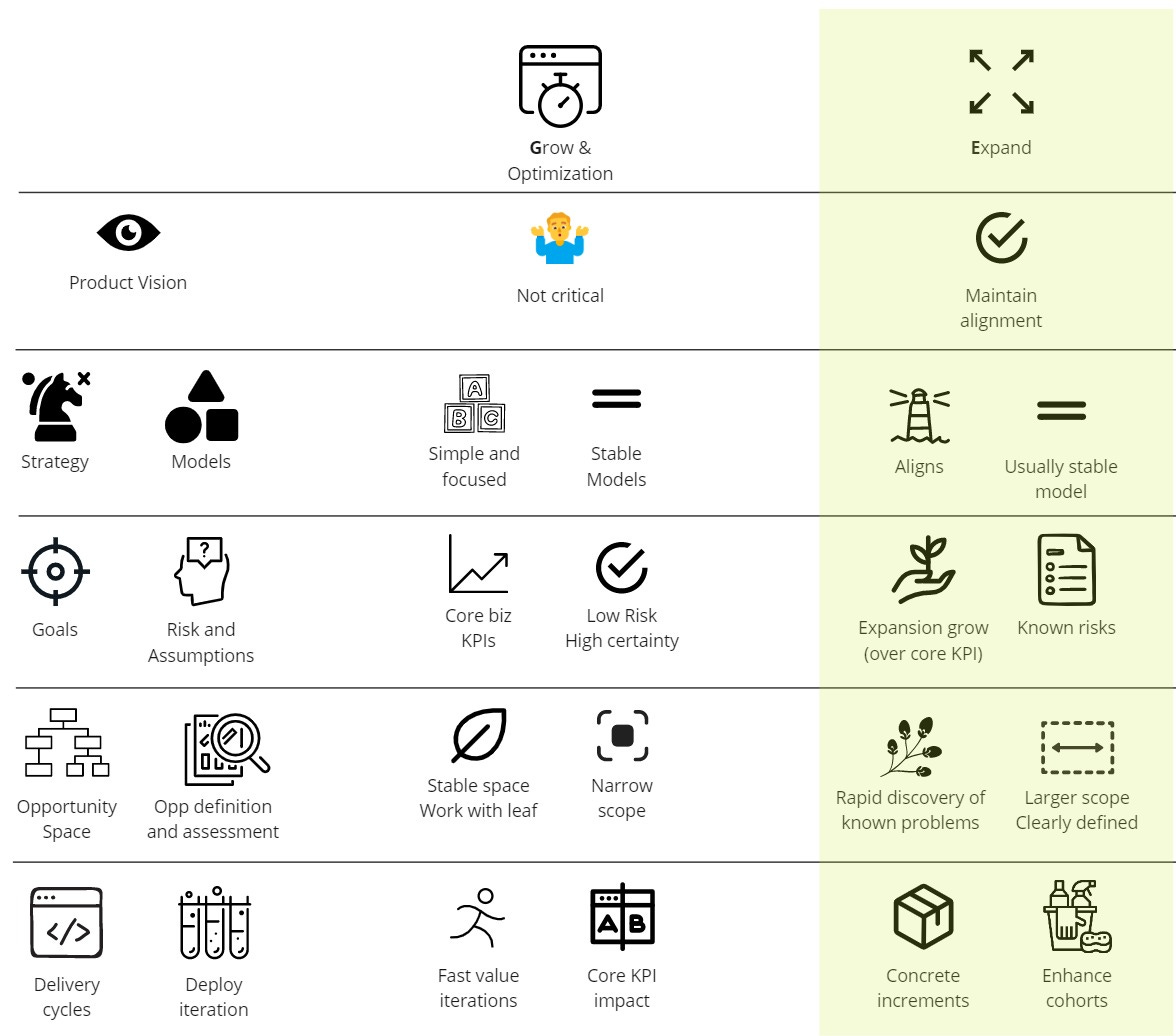

Let’s review how we should think for such a strategy in terms of the elements that connect Direction and Execution: (1) Vision, (2) Strategy & Models, (3) Goals & Assumptions, (4) Opportunity space & definition, and (5) Delivery cycles & iterations.

1. Vision

In an Expansion Strategy, the vision helps us maintain alignment and reduce the potential paths to the ones that fit the vision (for example, if we are trying to transform child education, we will not target adults as a potential expansion group).

2. Strategy and Models

Strategy plays a critical role in aligning the multiple efforts that will be needed to succeed in the expansion. As described before, it should be concrete to ensure that teams pull in the same direction, and can even include the strengths we should leverage, identifying the positioning that product teams should aim to create to conquer the users in this new market.

On the other hand, models tend to be stable, growing with the new expansions we are adding to the product. If we move to a new user segment, channel, or geography, the models that describe how the product and user needs interact remain mostly unchanged. If we integrate into a new platform or expand a new service, our model now has an extension, but the core remains stable.

3. Goals, Risks, and Assumptions

We created the strategy based on our assessment of different potential expansions. That assessment should unveil our strengths and weaknesses when entering this new market. For geographic expansion, we may have a more solid product than our competitors, but maybe we don’t have the right payment methods. For a platform expansion strategy, we may have a new unique value proposition for users, but we will have limited options to communicate it. The risks are usually known, even when they need to be explored in more detail to make concrete assumptions and tests.

And as mentioned, the measure of success should revolve around seeing early signs of growth and retention in the new market, not trying to make an impact on core KPIs. The reason is very simple: if you have a $100MM business, when doing an expansion, you may reasonably expect a +X% (let’s say +10% revenues, so +$10MM). But this would take time to build… maybe you will see a 0.001% increase in the first quarter. The goal is to see that those initial customers are retained and that the growth Q over Q is significant, regardless of their overall percentage. Many expansions are killed too soon for this reason.

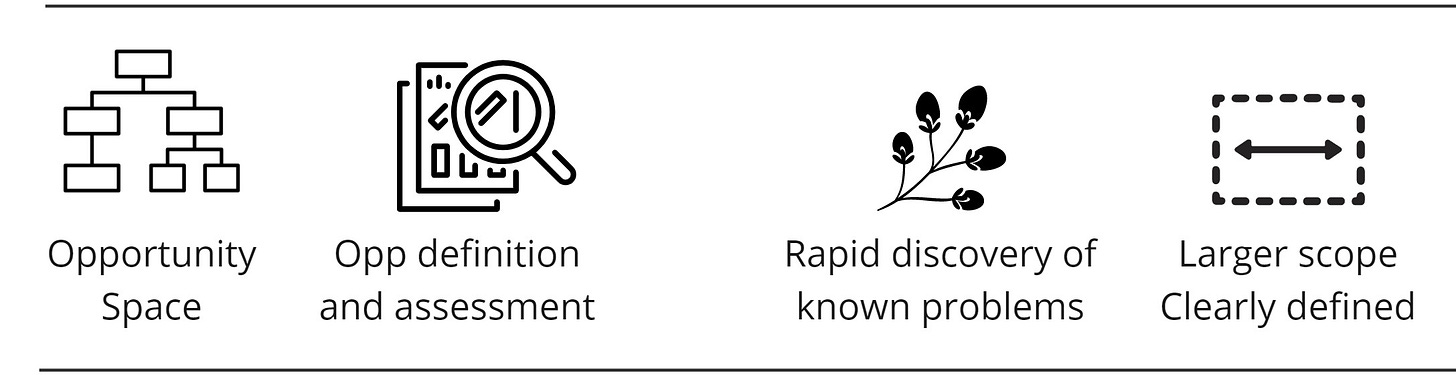

4. Opportunity Space and Assessment

Similar to what we said about risks, the scope of opportunities should be given by the strategy. The scope is larger and depends on the type of expansion, for example:

Upmarket: what do bigger enterprises need to adopt the service?

Downmarket: how can we change our customer service to support a larger user base?

Channel: how do we adapt onboarding to users coming from new sources?

So the problems are relatively understood, and our goal is to iterate rapidly on how to solve them (which inevitably also helps us better understand the problem).

5. Delivery cycles and iteration

While we will slice our value increments, this scenario is definitely different from optimization: “launching” the expansion usually is a considerable increment.

The most critical phase is the after-release enhancement. Different from the A/Bs we do in optimization, in expansions, we want to see if our cohorts are getting better over time (activating, retaining, engaging better).

So we need to be able to rapidly collect feedback (quantitative and qualitative) and deploy enhancements that we will test in the next cohorts of users that sign up.

Conclusions and Jump to Mutate

Expansion strategies are very powerful and could be very successful using the right playbook.

Our next article will review the last type: how to execute “Mutate” strategies successfully!